PURCHASE REAL ESTATE WITH YOUR IRA

A self-directed IRA is used for real estate investing.

If you have been frustrated over the performance of your IRA investments in stocks, bonds or mutual funds, investing your IRA funds in real estate may be a desirable alternative.

IRAs can be used to purchase real estate of any type, such as a single-family Home, commercial building or even raw land. However, there are rules and limitations regarding how IRA-owned real estate can be purchased and used. Violating these rules can result in adverse tax consequences.

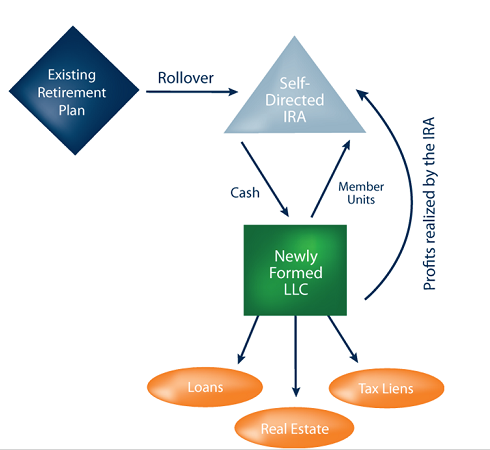

Self-Directed IRA

Although IRS rules permit IRA funds to be invested in real estate, IRS rules do not require an IRA trustee to offer real estate as an investment option. Most trustees who offer traditional IRA investments, such as depository banks, do not allow an IRA owner to invest in real estate because of the extra administrative burden of real estate management. As a result, if you want to invest your IRA funds in real estate, you will most likely have to convert your traditional IRA to a self-directed IRA—which is an IRA that requires you to decide what investments to make, such as real estate. In general, you can establish a self-directed IRA with a nondepository bank or trust company.

Prohibited Transactions

IRS rules require IRA-owned real estate to be for investment purposes only. This requirement places several prohibitions on how the real estate can be purchased and used. Key to understanding the prohibitions is the term “disqualified persons.” This term is used in the IRS rules regarding IRA-owned real estate to refer to the IRA owner and related persons--that is, the IRA owner and spouse, ancestors (mother, father, grandparents) and descendents (children, grandchildren and their spouses). The term disqualified person also includes the IRA-owner & investment advisers, including a trustee of the IRA funds, and any business in which a disqualified person has a 50 percent or greater interest. IRS rules prohibit the use of IRA funds to purchase real estate from a disqualified person. The rules also prohibit a disqualified person from using any real estate purchased with IRA funds, either as a home or business. These rules even preclude you from purchasing a vacation home that is only partly for personal use and otherwise rented to others.

Financing Issues: UDFI Tax

If you use all cash to purchase your IRA-investment real estate, the income produced by the property and the gain from a future sale of the property will remain in your IRA tax-deferred until you start taking distributions. However, if you acquire a mortgage as part of your purchase of the real estate, you will have to pay taxes on any income or gain attributable to the financed part of the transaction, called Unrelated Debt Financed Income, or UDFI. With regard to a mortgage, you must also keep in mind that you cannot guarantee repayment of the mortgage, as this would violate the disqualified person rule. This may require you to use another property as additional security for the lender or pay a higher interest rate and other costs.

Tax Consequences

If you violate the IRS rules regarding prohibited transactions, the IRS will consider the IRA funds used in the transaction as a distribution of your IRA. You will be taxed on the funds from the first year in which the transaction occurred, with penalties and interest included. Depending on your age, you may also incur an additional penalty for taking an early distribution.

Check out the "ALL MLS LISTINGS" link above to search for income and owner occupied real estate options.

Contact our office with any questions.

how to purchase real estate using your ira account. buy income property using an ira. information on how to use your ira to purchase real estate. ann arbor real estate for sale using your ira account. tom stachler with real estate one can help you make the right investment and real estate purchase decisions. real estate one ann arbor michigan saline dexter ypsilanti realty to purchase